Bound4Retirement

Independent Financial Advisers specialising in Financial Planning for those approaching and at retirement. In addition to Pension Advice; we advise on other aspects of this important time in your life, including Inheritance Tax Planning to preserve Family Wealth, Long Term Investment Strategies balancing Growth & Income. Using Goal Orientated advice, combined with Evidence Based Investing, we bring experience and expertise to provide you with the very best Financial Planning you would expect from a Chartered Financial Planner.

Independent Financial Adviser

Welcome to

Bound4Retirement

Working out of Gloucester, I am a Chartered Financial Planner with over 20 years’ experience.

As a Chartered and Independent Financial Adviser I provide unrestricted, whole-of-market financial advice.

My Chartered Financial Planner status also proves that I am qualified to the highest level in the industry, with this particular standing being widely regarded as the ‘gold standard’ for financial advisers.

My experience in Financial Services has given me the ability to focus on what really matters to my clients; ensuring that your goals are addressed, and practical retirement strategies are put in place, regularly reviewed and progress monitored.

INVESTMENT

Our services relate to certain investments whose prices are dependent on fluctuations in the financial markets beyond our control. Investments and the income from them may go down as well as up and you may get back less than the amount invested. Past performance is not a guide to future performance.

The most popular saying amongst investment advisers is Time in the Market not Timing the Market.

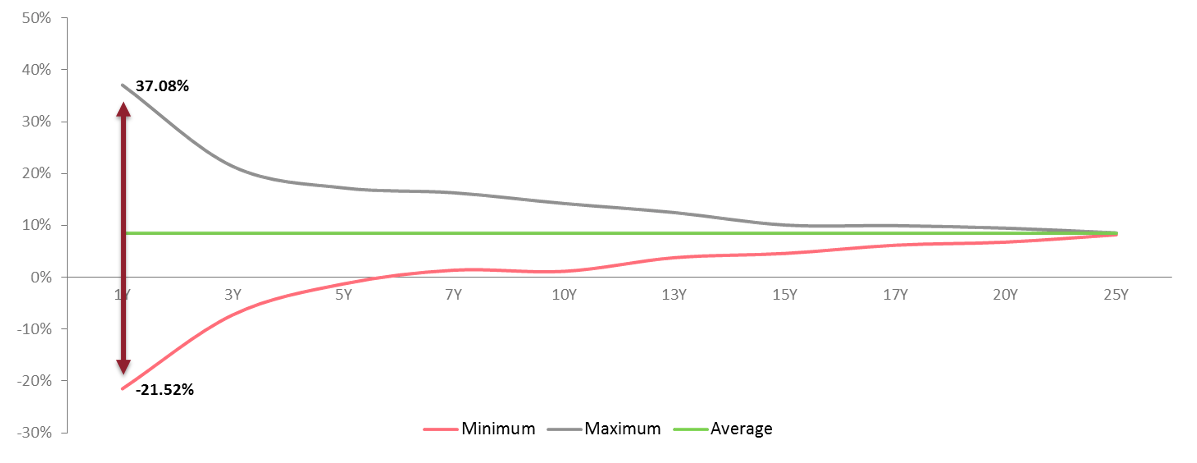

As Financial Planners we do not try to beat the markets by moving in and out of investment positions in the short-term but we feel that gains are best accrued through investing for the long term. For this reason, any investment must be for long-term i.e. at least 5 years. Whilst this timeframe does not give any guarantee that returns will be positive at any given point after 5 years; historically, an investment over and above this timeframe gives a realistic chance of positive growth.

Of course, past performance is no indication of future returns and there may be times of volatility that would be inappropriate to encash an investment.

The illustration below shows the investment returns over 25 years of a typical investment portfolio, showing maximum (gains) and minimum (losses) returns each year. This highlights the need for investments to be held for at least 5 years.

Equities have always been the driving force for long-term returns and as such make up the bulk of an investment portfolio to varying degrees. In times when markets drop, it can be an easy mistake to encash funds when the right thing to do would be to remain invested.

The graph shows how equities (blue) have performed over the last 15 years in comparison to Cash (green). The red line plots the Retail Price Index over the same period, showing how the value of Cash would be eroded by inflation and how equities can provide growth over and above inflation.

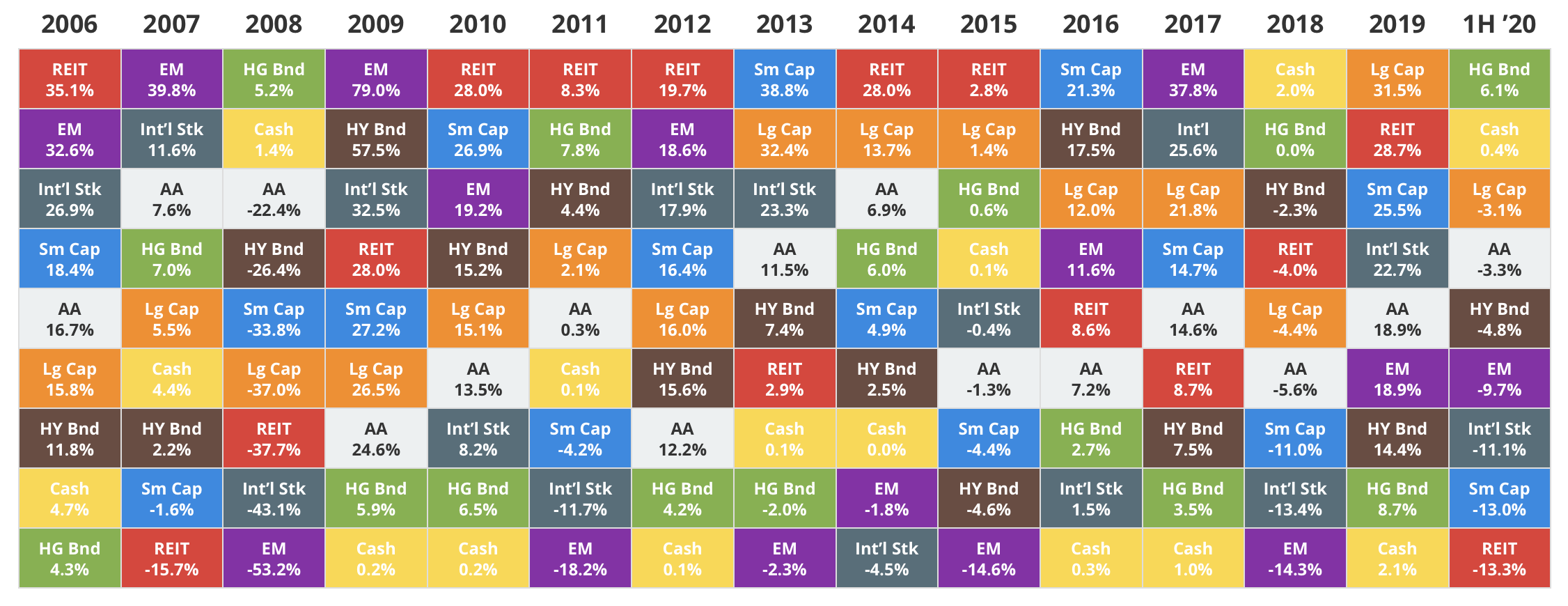

As for Time in the Market, your investments should be adequately diversified. The colourful chart here shows the varying performance each year since 2006, of the different types of investments year on year. Every year each type of investment performs differently; unfortunately, we do not have a crystal ball to tell us which is to perform the best each coming year and as such we look to have your money invested across different asset classes to balance this variation in performance.

Sometimes the conversation can be paradoxical, if you do not have much money to meet your goals then it may be prudent to invest more cautiously to ensure that you are not adversely effected by drops in the market when the time comes to take money from the investment. If you have a healthy Cash reserve then you have the ability to withstand Volatility and therefore able to take more Risk in your long term investments.

A key aspect of Financial Planning, this conversation sometimes means that Goals have to be revised to meet your financial situation, different strategies may need to be considered, such as taking retirement later than envisaged or phasing retirement over time to give adequate income.

At times it means that Goals have to be reduced to be realistic in meeting your needs.

Time is important when it comes to Capacity for Loss; essentially, the earlier you start investing the better position you will be in.

The subject of Risk can be very emotive; when this is discussed with clients, a common question is whether they may lose all their money. This is a common concern; though in actuality, Risk really means Volatility. The higher risk an Investment Portfolio, the more volatile the performance. This chart shows three Portfolios; Aggressive, Balanced and Cautious Risks.

As can be seen, the Aggressive Risk Portfolio gives greater returns over the long term (typical of the Risk Return Reward theory) than the Balanced or Cautious Portfolios.

Dependent on the investment timeframe it is typical to be invested in a higher risk portfolio and then as we have annual reviews and you get closer to taking income and/or capital from your investment to start to move into lower risk investments to reduce volatility as your Goal approaches.

Again; as highlighted in Capacity for Loss, having adequate Cash holdings allows you to withstand Volatility, purely from being able to defer withdrawing from an investment portfolio when markets have incurred losses.

Having discussed all the advantages of Investments over Cash, that’s not the whole story.

Cash plays a very important role in any Financial Plan, for at least 3 reasons:

- Emergency Cash Fund

- Short-Term Goals

- Investment Flexibility

Emergency Cash Fund

One of the pillars of financial planning, an Emergency Cash fund is essential for all clients. It is important to have Cash you can access quickly should you need it. The exact amount varies from adviser to adviser but the general rule of thumb is to ensure that you have 4-6 months’ worth of your monthly expenditure to be able to draw upon in time of need.

Short-Term Goals

Capital required over the short-term is best funded from Cash, certainly money required for such things as a holiday or car purchase within 3 years would not be funded from money invested in Equities and similar asset classes.

During an Annual Review; dependent on market conditions as we approach a goal, we may look to “bank” any growth in times of good market conditions to fund approaching Goals as they draw near.

Investment Flexibility

Many Investment Professionals will look to hold a certain amount of cash within the investment portfolio. Whilst only a relatively small percentage, the liquidity this provides can be valuable to take advantage of opportunities in investment markets.

INVESTING ETHICALLY

At its core ‘Ethical Investment’ is a range of investment styles which go beyond simple financial returns to incorporate client’s ethical, social and environmental values into the investment process. This area is also often referred to as Sustainable and Responsible Investment (SRI).

- Choosing An Ethical Portfolio

- Responsible Leaders

- Sustainability Leaders

- Ethical Leaders

- Traditional Ethical Leaders

Where the emphasis is placed between the positive and negative characteristics depends upon the style of investment concerned and the ethical policies the fund manager chooses to use.

CASHFLOW PLANNING

Cashflow Planning is a key tool for a Financial Planner and is the difference between an adviser who will plan and regularly review your Goals and an adviser who is just interested in selling you a financial product.

Using Cashflow Planning we are able to anticipate how you may achieve your Goals. It does take some work on behalf of the client in that you need to spend time detailing your current expenditure and what you may need in retirement. However, it is a valuable exercise that once completed lays the foundations for long term Goal orientated planning.

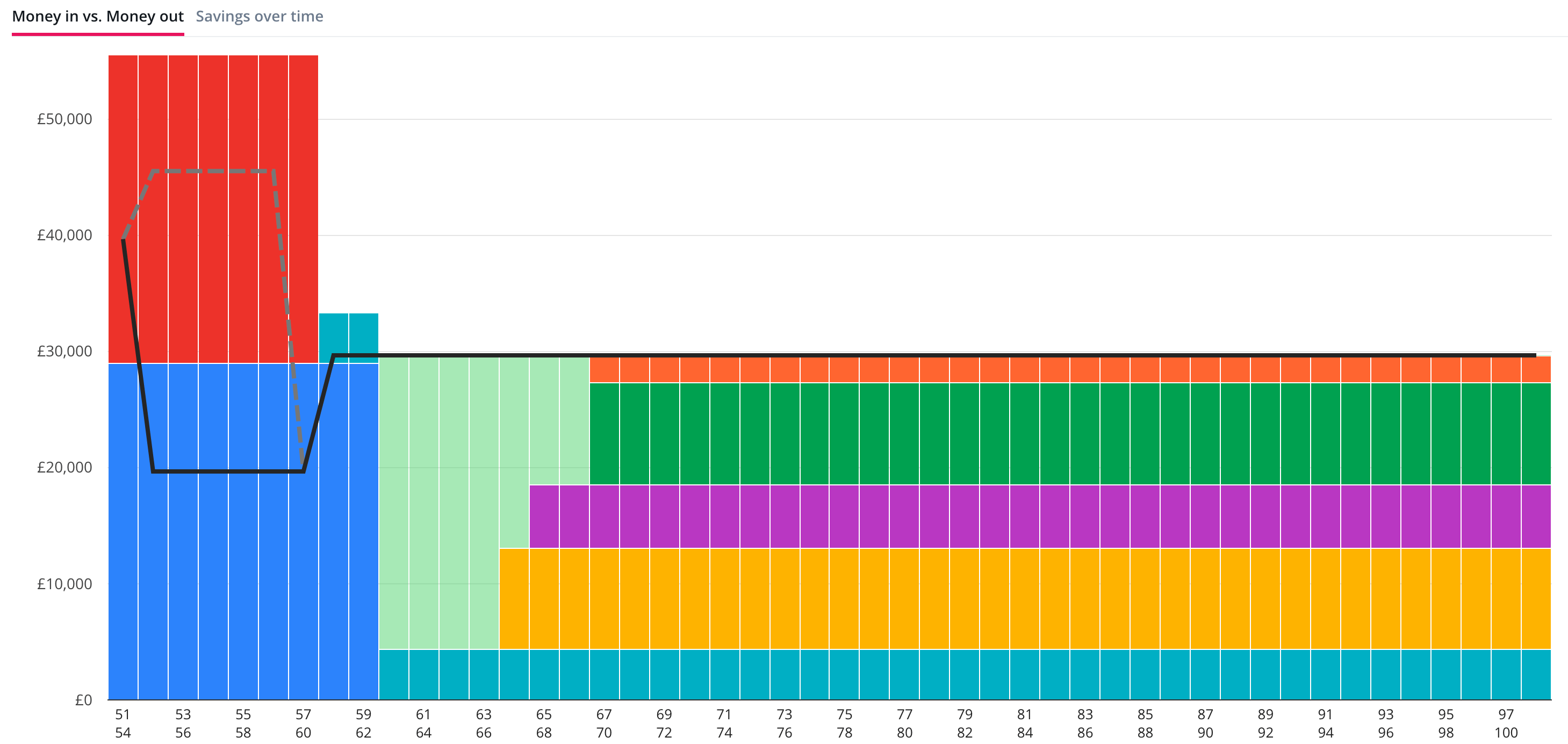

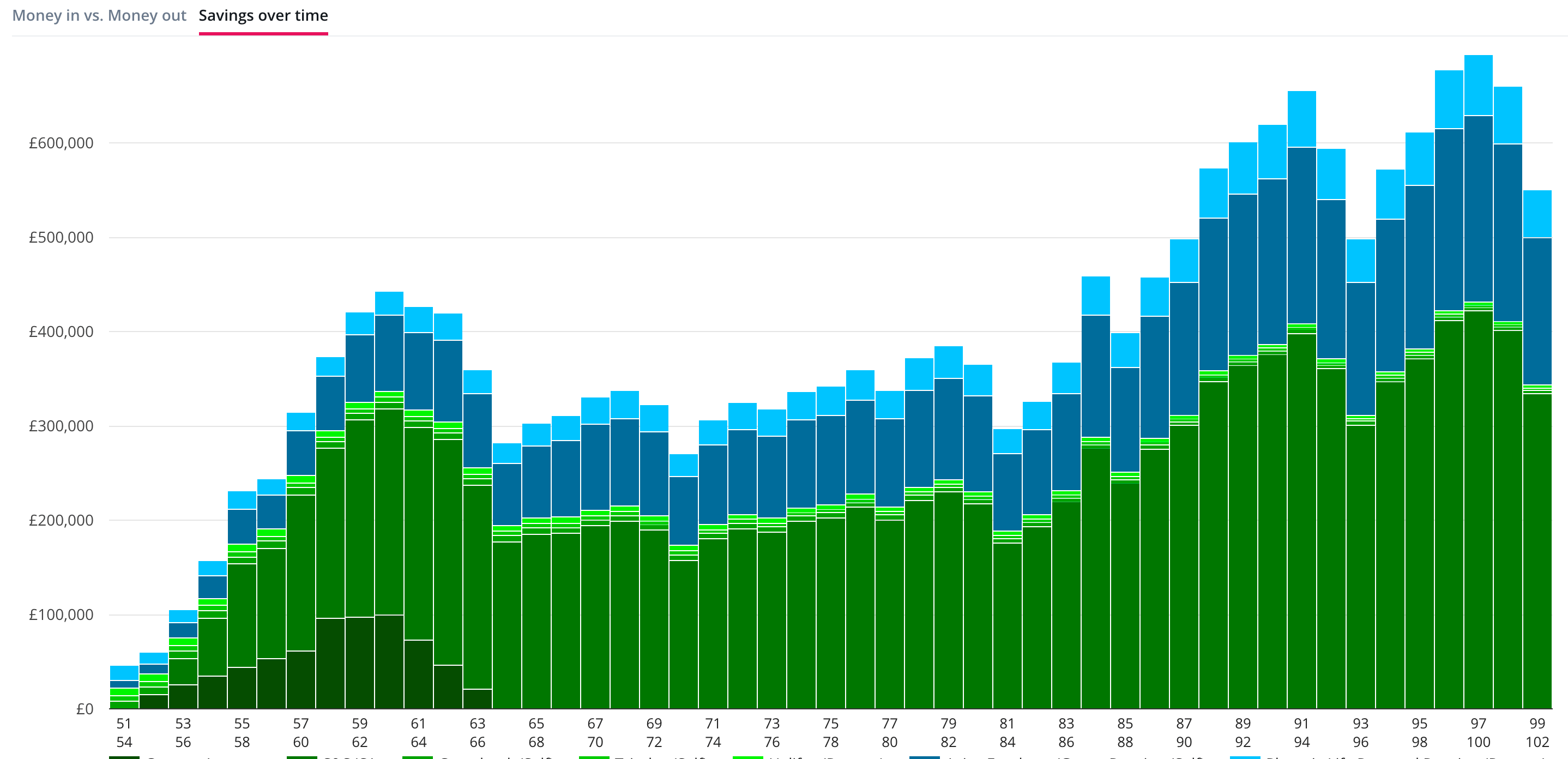

By looking at Income and Expenditure we are able to identify times where there may be a shortfall in income, typically from the time people wish to stop working (or move to Part Time hours through phased Retirement).

In the Income vs Expenditure model shown the light green part from ages 60 to 66 shows a Shortfall in income to meet expenditure and the need to plug this gap from Investments and/or Pensions to fund a Goal of retiring at age 60.

By forecasting how investment returns may be and having an appropriate Emergency Cash Fund, careful planning and reviews allows your adviser to plan effectively to meet your Goals.

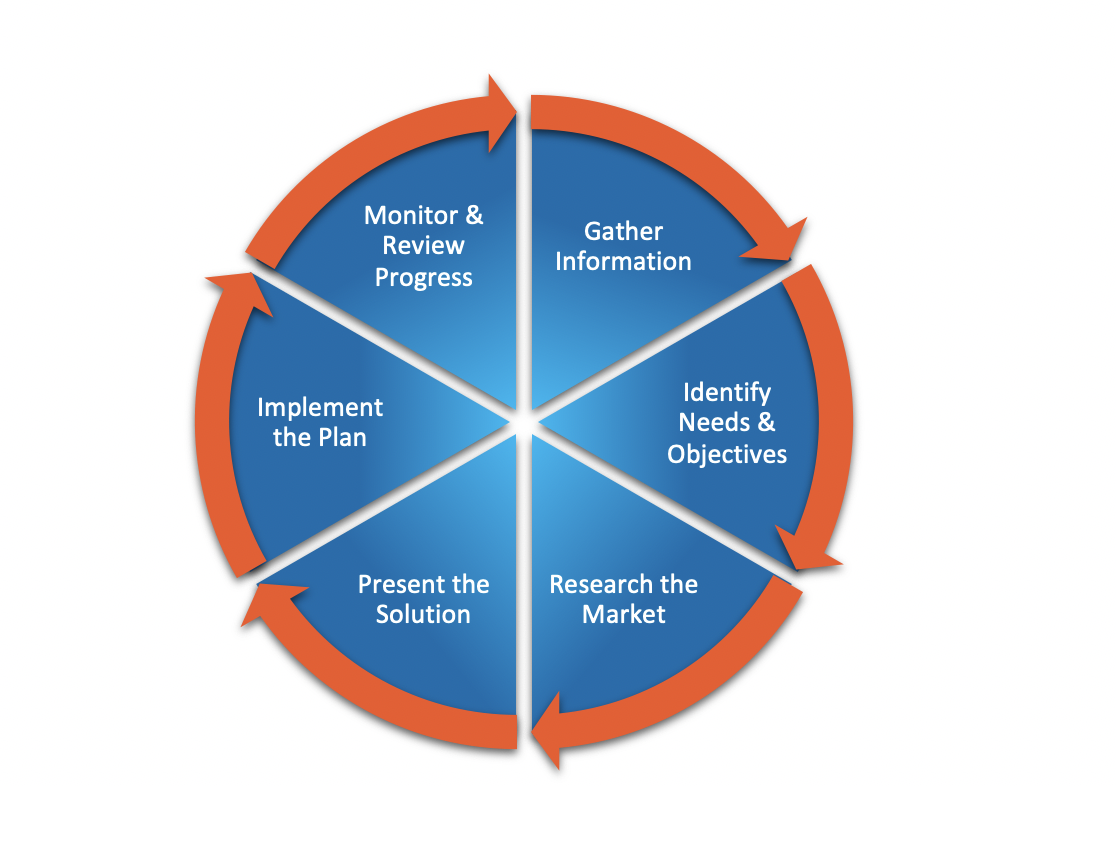

ADVICE PROCESS

Part of this discussion will involve an Attitude to Risk Questionnaire which will assist in recommending the best strategies suited to your risk appetite.

After this meeting you will understand the principles of Financial Planning that we will base our advice on, be prepared for and have agreed to proceed to the second meeting where we present our advice.

Between appointments, a highly skilled paraplanning team assists with researching appropriate options and putting together a solution tailored to your goals.

When we present our advice on our second meeting, we will provide you with a Suitability Report explaining the recommendation. If a recommendation includes purchasing new financial products, other documentation including an illustration will be provided. Costs of the advice and any charges of recommended investments and products will be explained before you agree to proceed.

ABOUT US

Welcome to Bound4Retirement.

We’re dedicated to giving you the very best advice when whether you are just starting pension savings, approaching retirement or require advice in retirement.

Founded in 2019 by Alex Bound, Bound4Retirement was borne out of a vision to provide his existing clients with a first-class service, providing the best advice possible. A career in Financial Services has seen him build 20 years of experience giving financial advice and has culminated in building a successful and highly regarded business.

Bound4Retirement was set up in October 2019 and specialises in wealth management and lifetime planning. In addition to Pension Advice; Bound4Retirement advises on other aspects of this important time in your life, including Inheritance Tax Planning to preserve Family Wealth, Long Term Investment Strategies balancing Growth & Income. With a large and established client base, Alex realised that many of his clients found it hard to find a Estate Planner they could trust and provide the service that is required for the right cost. The solution to this was to bring it all “in-house” – and so our sister company, Legally Bound was born..

If you have any questions or comments, please don’t hesitate to contact us.

Alex Bound

Co-owner of Bound4Retirement and Legally Bound along with my wife,; I have 20 years’ experience of financial services with an Advanced Diploma in Personal Tax & Trust Planning as part of my Chartered Financial Planner status. Having worked with 5 different companies over the 20 years I have long been planning on how best to provide the best services for my clients and this has led me to finally launch my own companies after careful consideration of my client’s needs.

I’m now a retired rugby player but it is still my passion, I am a season ticket holder at Kingsholm (in the Shed of course) and try to get to at least one away European game each year. I also love Skiing and sometimes I get to combine a trip away with the rugby and skiing at the same time.

Father to a beautiful daughter.